Newsletter

Personalized Service, Proven Results, and a Commitment to Your Success

10 Affordable Tax Consulting Tips for Startups to Maximize Savings

The primary inquiry posed by the title "10 Affordable Tax Consulting Tips for Startups to Maximize Savings" revolves around how startups can effectively leverage tax consulting to bolster their financial savings. This article delineates a range of strategies essential for navigating the complexities of taxation. Startups must:

- Grasp their tax obligations

- Choose the appropriate business structure

- Take advantage of available tax credits and deductions

Furthermore, consulting with professionals is crucial for optimizing savings. By implementing these strategies, startups can enhance their operational efficiency and support their growth trajectory.

Introduction

Navigating the financial landscape presents a formidable challenge for startups, particularly regarding the complexities of tax obligations. The potential for substantial savings through strategic planning offers new businesses a unique opportunity to utilize affordable tax consulting, thereby maximizing their financial outcomes. Yet, the pressing question persists: how can startups effectively implement these strategies to ensure compliance while optimizing their tax position? This article explores ten essential tips designed to empower startups to take control of their tax strategies, ultimately enhancing savings and fostering sustainable growth.

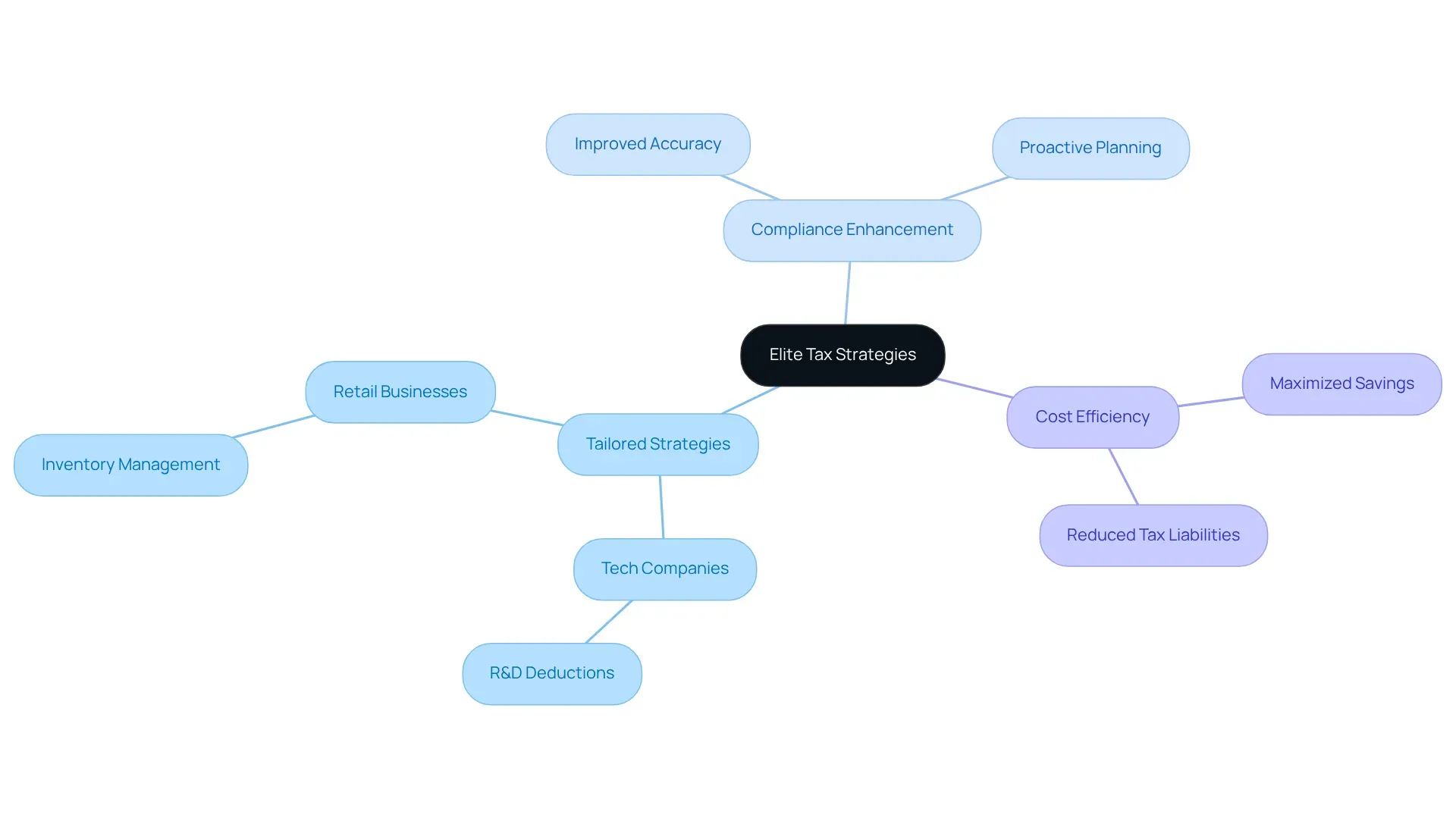

Elite Tax Strategies: Personalized Tax Consulting for Startups

Elite Tax Strategies excels in delivering affordable tax consulting for startups specifically tailored for new businesses. By recognizing the distinct challenges that emerging enterprises encounter, the firm crafts bespoke tax strategies that align seamlessly with each business's financial objectives. This personalized approach not only enhances compliance but also includes affordable tax consulting for startups, maximizing potential savings and allowing new businesses to focus on growth without the burden of tax-related concerns.

Consider, for example, a fledgling tech company that stands to gain from specific deductions related to research and development. In contrast, a retail business may prioritize inventory management strategies to optimize its tax outcomes. Elite Tax Strategies is committed to ensuring that every client receives a tailored plan that reflects their operational framework and financial goals.

Are you ready to alleviate your tax worries and empower your business's growth? With Elite Tax Strategies, you can navigate the complexities of taxation with confidence and clarity.

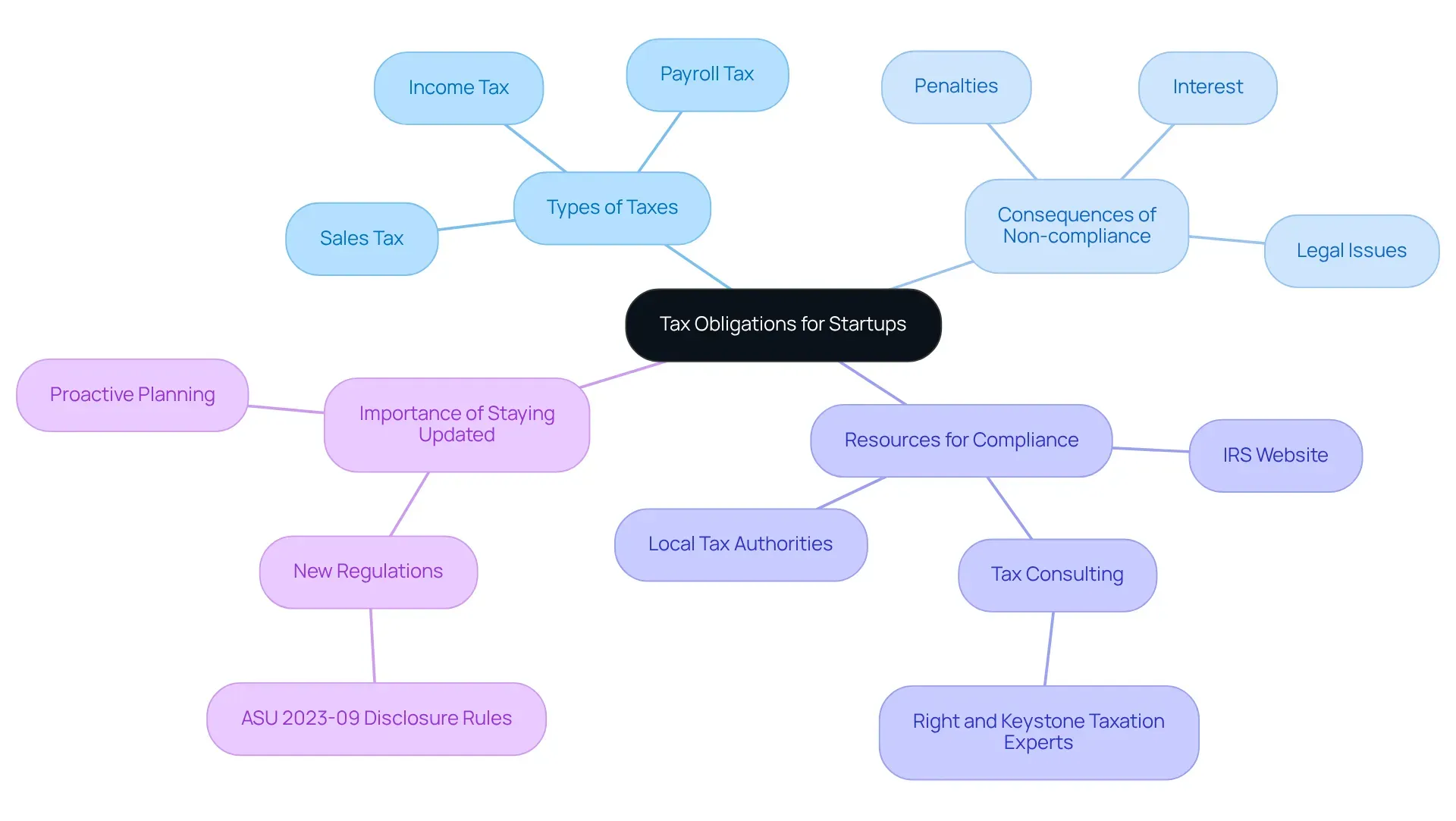

Understand Your Tax Obligations: Essential for Startup Compliance

The Understanding tax obligations is crucial for new businesses aiming to maintain compliance with federal, state, and local regulations. Startups must familiarize themselves with various tax types, including income tax, payroll tax, and sales tax. Non-compliance can lead to significant penalties, interest, and potential legal issues, underscoring the importance of proactive tax management.

How can startups ensure they meet their tax obligations? Consulting resources such as the IRS website and local tax authorities is essential for staying updated on specific requirements. Engaging with affordable tax consulting for startups can provide clarity on filing requirements and deadlines, helping startups avoid costly mistakes. For instance, a small retail business improved its tax compliance through a proactive planning strategy with the assistance of Right and Keystone Taxation Experts, resulting in better accuracy in reporting and reduced tax liabilities. Similarly, a freelance advisor enhanced tax deductions through professional advice, leading to significant tax savings and increased economic awareness.

Furthermore, comprehending local tax regulations, including taxable presence triggers and filing deadlines, is essential for new businesses, particularly those contemplating growth. As new regulations emerge, such as the ASU 2023-09 disclosure rules requiring private companies to report tax liabilities in each jurisdiction starting December 15, 2025, staying informed becomes even more critical. By prioritizing tax compliance and leveraging expert advice from affordable tax consulting for startups, new businesses can effectively navigate the complexities of tax regulations and maximize their financial outcomes.

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales

Guy Hawkins

President of Sales